Valuable for American Manufacturers

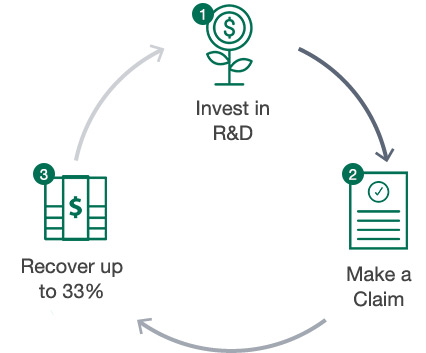

The R&D Tax Credit, which has been in effect since 1981, is an important tax credit that is available to American businesses that innovate.

Call one of our R&D tax experts at (712) 324-4614 or (605) 610-4611 to learn more or to register for a FREE preliminary analysis.

Think it doesn’t apply to you? Think again.

Even if you are not developing new products, you may qualify. You may be eligible for this valuable tax credit if you:

Why the R&D Tax Credit?

U.S. manufacturers are under intense global competition and the credit is designed to protect American jobs and spur innovation. And there is good evidence that the credit really does work.

At Cain Ellsworth, we know taxes and we know manufacturing. In fact, we have been serving the manufacturing industry since 1968 and we work closely with our clients to make sure they are taking advantage of every possible tax benefit. Our R&D tax experts are in the field working with our clients to ensure proper documentation and support and maximize their tax credit.

Tax Planning Services

- Manufacture products

- Develop new, improved or more reliable products, processes, or formulas

- Improve processes or reduce waste

- Design tools, jigs, molds, dies

- Develop prototypes or models

- Perform testing

- Test new materials

- Develop, implement, or upgrade software or systems

- Add new equipment

- Streamline processes